31.08.2011 14:25

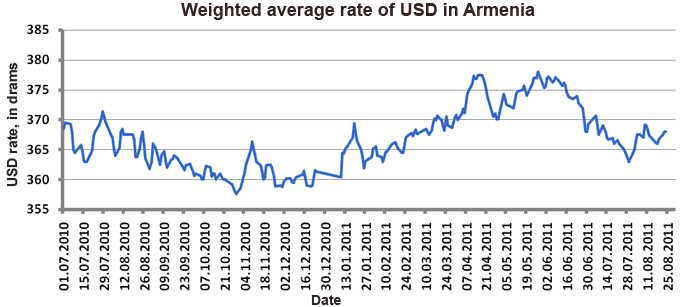

YEREVAN, August 30. /ARKA/. Last week, the USD average rate in NASDAQ OMX Armenia stock exchange increased by 0.3% to 367.96 AMD. Trading volume for the week was 9.6 million USD which is by 37.7% lower than the previous week. Average rate of cash dollar sales increased by 0.42%, and on Saturday on August 27 it was 370.20 AMD.

Increase of USD in Armenia is due to the continuing demand for U.S. currency by the public and businesses on the background of increased uncertainty in the world financial markets in relation to the delay of the world economy and fears about dissemination of debt crisis in larger euro zone economies.

This week continued growth of USD to AMD will keep a little cooled down demand for foreign currency and the public.

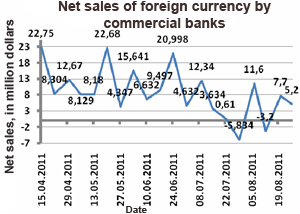

Thus, according to the press review of CBA, last week intra-exchange market volume of net sales of foreign exchange by commercial banks amounted to 5.2 million USD which is by 32.5% less than last week.

However, as the balance of net sale of dollar by commercial banks is positive, we do not exclude that the cost of U.S. currency in Armenia may recover. Average rate of USD in NASDAQ OMX Armenia stock exchange can test the strength of resistance level of 370 AMD and the average selling rate of cash dollar in Armenia next week will be between 368 – 373 drams.

Cost of euro last week in Armenia was determined by events occurring in the global currency market FOREX where EUR/USD rose by 0.7% to 1.4497.

Nevertheless, single European currency continues to remain under the pressure on the background of debt problems of peripheral euro zone countries and risks of dissemination of debt problems in larger economies of the region. Macroeconomic statistics from the U.S., particularly the revised data on U.S. GDP for the second quarter, also is not optimistic. The indicator was worse than forecasts. Thus, GDP volume of in the second quarter on annual basis increased only by 1.0% versus the growth by 1.3% in the first review.

In addition, the speech of Mr. Bernanke, the chairman of Federal Reserve System (FRS) at the symposium in Wyoming at the end of the week disappointed the market players, as he did not mention the additional incentive of monetary policy in the nearest future, despite the new signals of sluggish economic growth. Investors prefer to buy euro than dollars against the recovery of U.S. stock indices.

Average selling rate of cash euro in Armenia last week also reacted to these developments and increased by 0.62% to 536.56 drams.

This week the dynamics of euro in the world and accordingly in Armenia will be determined by the news of international market FOREX. Of macroeconomic statistics, in the focus of market participants will be publication of data in U.S. in August to change the number of people in the agency and people employed in non-agricultural sector. One of the news from euro zone is publication of Consumer Price Index in August.

If the predications come true and macroeconomic statistics from the U.S., particularly data from labor market again disappoint the market participants, concerns about slowing down of U.S. economy will grow, while euro may show a decline. This will contribute to the reluctance of the investors to take risks on the background of recent volatility in global financial markets. Support for the single European currency in the coming week will be the level 1.4250.

In the case if macroeconomic data from the U.S. will be positive, while the inflation data from euro zone will be better than expected, European currency will get an additional impulse for growth. Resistance level for euro in the next five sessions may be 1.4700. Average selling rate for cash euro in Armenia this week will be between 525 – 545 drams.

Average selling rate of cash ruble in Armenia during the previous week rose by 0.94% to 12.96 drams. This was due to increase of cost of Russian ruble to USD on the background of increasing risk of investors and strengthening of AMD against American currency.

Dynamics of Russian ruble to USD and accordingly to AMD this week will depend on macroeconomic statistics of USA and world oil prices. If the data from U.S. labor market will be better than expected, it can restore some optimism in the financial markets and support Russian ruble in the world market and in Armenia. Average selling rate of cash Russian ruble over the next five trading days is likely to be in the range of 12.80 – 13.15 drams

Mikayel Verdyan, analyst of FOREX CLUB, special for the agency “ARKA”

Opinion of the author do not necessarily correspond to the position of the editorial staff.

Read the news first and discuss them in our Telegram

Tags: