31.08.2011 14:32

YEREVAN, August 30. /ARKA/. Last week’s rally in the gold market has slowed down after six days of continuous growth, which resulted in the quotations of precious metals and reach new records of maximum 191.80 USD per troy ounce against the fears of dissemination of debt crisis in larger euro zone economies, as well as large sales in global stock markets.

Nevertheless, by mid-week the price of gold fell to its weekly minimum reaching to 1703.15 USD per troy ounce, as the recovery of quotes of leading stock indices in the world stock markets prompted market participants to fix their positions on precious metals after long growth. Besides, improvement of business activity index of industrial sphere of China promoted strengthening of the risk of investors becoming the starting point to reduce the gold price on Tuesday.

Indices of German research institutes ZEW and IFO appeared worse than expected. The revised data on U.S. GDP in the second quarter did not add the optimism. The index was worse than predicted. Thus, GDP volume in the second quarter on annual basis increased only by 1.0% compared to 1.3% in the first review. In general, macroeconomic statistics was negative which allowed gold to partially recover its position.

In addition, the speech of Mr. Bernanke, the chairman of Federal Reserve System (FRS) at the symposium in Wyoming at the end of the week disappointed the market players, as he did not mention the additional incentive of monetary policy in the nearest future, despite the new signals of sluggish economic growth. Investors prefer to buy euro than dollars against the recovery of U.S. stock indices.

As a result, the price of gold in the previous five trading sessions reduced by 1.35% to 1826.90 USD per troy ounce.

This week gold prices will be determined by macroeconomic statistics of USA and euro zone. Of macroeconomic statistics, in the focus of market participants will be publication of data in U.S. in August to change the number of people in the agency and people employed in non-agricultural sector. One of the news from euro zone is publication of Consumer Price Index in August. Of macroeconomic statistics, in the focus of market participants will be publication of data in U.S. in August to change the number of people in the agency and people employed in non-agricultural sector. One of the news from euro zone is publication of Consumer Price Index in August.

If the predications come true and macroeconomic statistics from the U.S., particularly data from labor market again disappoint the market participants and data of consumer inflation of euro zone will go higher than expected – 2.5% on annual basis, prices of yellow metal will get additional impulse. Resistance level of the next five trading days may be 1915 USD per troy ounce.

In case if macroeconomic data from the U.S. will be positive, while inflation data of euro zone will be worse than expected, gold may show a decline. Support for the precious metal in the next week can be the level of 1690 USD per troy ounce.

The cost of copper in the futures market last week increased by 3.26% to 4.102 USD per pound of copper. The reason for these are: first, the positive mood of market participants in the world stock markets with increased risks, second, declining USD and third, favorable macroeconomic statistics of China, particularly the index of business activity in the industrial sphere.

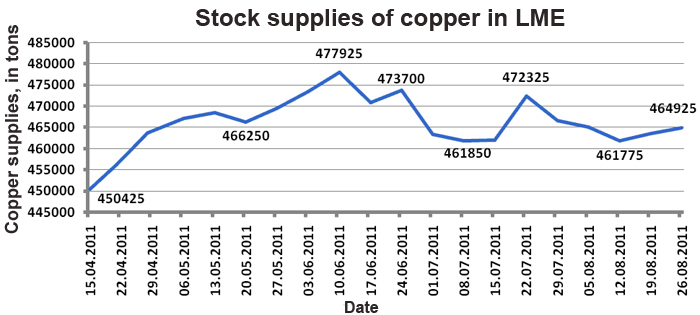

Negative statistics from the U.S., in particular, forecast data of GDP in the second quarter of this year, as well as rising commodity stocks of the given asset in the London Metal Exchange (LME) hindered the growth of the red metal.

This week the price of copper will be largely determined by the economic news from the U.S. and euro zone. If macroeconomic statistics from the U.S., particularly the number of new jobs in non-agricultural sector in August will be higher than expected, copper will get additional impulse for growth.

In case of negative economic data regarding the slowing down of American economy will grow, the red metal could begin to grow in price. The expected range of copper prices in the futures market next week may be 3.90–4.30 USD per pound of copper. -0-

Mikayel Verdyan, analyst of FOREX CLUB, special for the agency “ARKA”

Opinion of the author do not necessarily correspond to the position of the editorial staff.

Read the news first and discuss them in our Telegram

Tags: