06.02.2012 18:04

YEREVAN, February 6. /ARKA/. On the first day of trading last week gold has shown a weak downward trend, as investors kept cautious, watching the progress of EU summit in Brussels. Continuing negotiations of Greece with private creditors regarding restructuring of state debt assisted in strengthening of tension in the market. Having grown up over 15% ten-year government bonds of Portugal also put pressure on gold.

However, from Tuesday, January 31, the situation in the gold market changed for the better. The precious stone continued to increase by Friday, February 3 against the background of significant progress against establishing a closer fiscal union in Europe, as well as the leaders of twenty-five EU countries signed an agreement on the continuing stability in the amount of 500 billion euros.

Positive macroeconomic stability from eurozone also assisted in the gold price increase.

Indeed, the final data on PMI index for manufacturing sector in January increased to 48.8 vs. December data - 46.9. By the end of the week, during European trading session, quotes of precious metal reached new 11-week maximum – 1763.11 USD per troy ounce.

Nevertheless, during American trading session, on Friday, February 3, gold price started to decrease. Regular downward impulse of precious metal quotes received after the release of more favorable than expected data on the number of new jobs in the U.S. non-agricultural sector. Thus, index in January increased by 243.0 thousand tons vs. forecasted 145.0 thousand, unemployment level reduced to 8.3% compared to 8.5% in December.

In the result, gold price last week reduced by 0.73% to 1725.08 USD per troy ounce.

Next week there may be a slight reduction or consolidation of gold price, as much positive data on U.S. unemployment market significantly weakened investors’ hopes for a new incentive program for the promotion of American economy. However, quote reduction of the precious metal will be limited by stable investment demand on the background of economic instability in Europe. Support for the yellow metal in the coming week will be 1680 USD per troy ounce.

Planned macroeconomic statistics from the U.S. and eurozone can affect the dynamics of precious metal next week. From the American news is worth paying attention to data on trade balance for December. From European news is worth paying attention to final data by index of consumer prices of Germany in January, as well as European Central Bank meeting on percent rate and traditional press-conference of its Chairman Mario Draghi, planned on Thursday, February 9. It is expected that European regulator will keep the rate unchanged, on the level of 1.0%. In case, if the expectations were justified and the comments of Mr. Draghi will appear moderately positive, gold can probably resume its growth. Resistance level of the next five trading sessions can be 1775.0 USD per troy ounce.

Copper price in the futures market next week increased by 0.22% to 3.9050 USD per pound of copper. Red metal during the week except Friday was traded by decrease. Continuing concerns about instability of European economy hindered copper growth. However, on Friday, February 3, copper price in the futures market jumped abruptly. Its reason was positive macroeconomic statistics on employment in the U.S. non-agricultural sector in January.

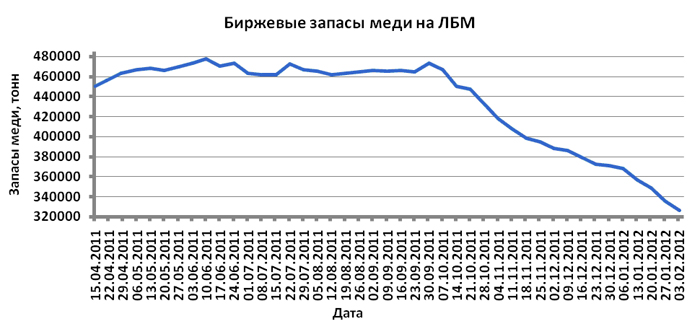

Additional support factor for red metal last week became declining stock of reserve assets on London Metal Exchange (LME).

Copper dynamics next week will depend on the events in eurozone. In the focus of market participants will be the regular meeting of ECB on percent rate, as well as traditional press-conference of its chairman Mr. Draghi. In case, if the comments of the chairman will appear moderately positive, copper can continue its growth. At the same time, continuing negotiation of Greece with private creditors regarding restructuring of state debt will assist the maintenance of tension in the market, thereby preventing the growth of copper.

The expected range of fluctuations in copper price in the futures market this week will be 3.75 – 4.05 USD per pound of copper.

Mikayel Verdyan, analysts of Forex Club

The opinion of the author do not necessarily represent those of the edition.

Read the news first and discuss them in our Telegram

Tags: