24.03.2012 13:39

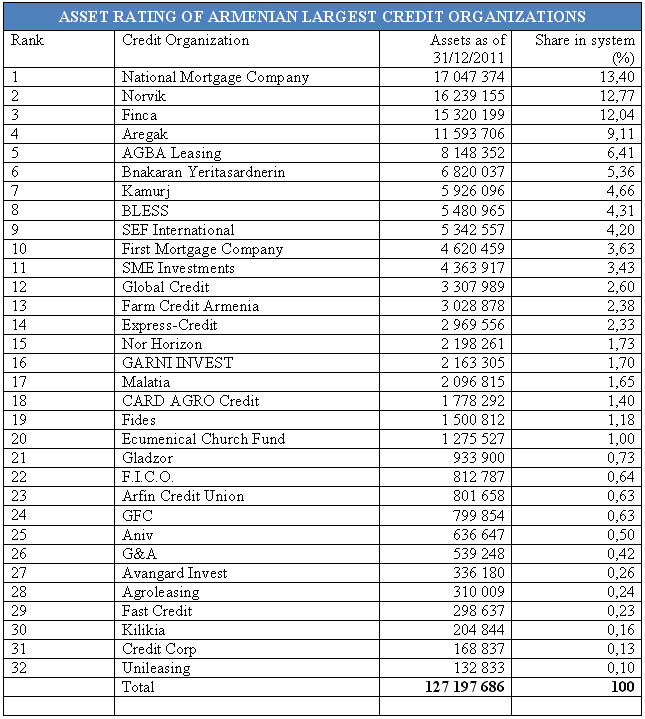

YEREVAN, March 24./ARKA/. ARKA News Agency has released its regular quarterly rating on Armenian leading credit organizations’ assets.

*thousand drams

National Mortgage Company, whose assets exceeded AMD 17 billion and made up 13.4% of Armenian credit organizations’ aggregate assets by late December 2011, is topping the rating.

Norvik universal credit organization, with its AMD 16.2 billion and 12.77% share in credit organizations’ aggregate assets, is the second biggest asset owner in ARKA News Agency’s ranking.

Finca with its AMD 15.3 billion and 12.04% ranked third.

Aregak credit organization came fourth (AMD 11.59 billion and 9.11%), and AGBA Leasing fifth (AMD 8.14 billion and 6.41%).

Other five companies among top ten asset owners are Bnakaran Yeritasardnerin (Apartments to Young People), with its AMD 6.82 billion, Kamurj (AMD 5.82 billion, BLESS (AMD 5.48 billion), SEF International (AMD 5.34 billion) and First Mortgage Company (AMD 4.62 billion).

Armenian credit organizations’ assets totaled about AMD 127.2 billion in late Dec 2011 after growing 41.42% from AMD 89.9 billion in Dec 2010.

Thirty two credit organizations operate in Armenia now.

Remarkable is that credit organizations’ assets constituted only 6.13% of banks’ aggregate assets and 58.2% of the assets of the country’s largest bank.

The top five credit organizations account for 53.73% of the market, and top ten 75.89%.

Small sizes of Armenian credit organizations are due to specifics of their activity – the bulk of banks’ resources come from deposits, while credit organizations have no such an opportunity, and this limits credit organizations’ resources.

Besides, banks are always more popular in Armenia than any other financial institution, and potential borrowers first try to take money from banks, where interest rates on loans are lower than in credit organizations.

In December 2011, banks extended loans in drams at 16.1% average interest rate, while credit organizations lent money at 20.7%.

At the same time, Armenian credit organizations have accomplished a great deal in shaping own customer mix, they are successfully financing their clients.

This shows that there is a fierce battle for clients at Armenia’s credit market.

The source of this asset rating is ARKA News Agency’s “Credit Organizations of Armenia” quarterly bulletin.

More detailed information on all indicators is available in the mentioned bulletin that is based on credit organizations’ financial reports published by the press and additional information released by credit organizations themselves.

“Credit Organizations of Armenia” quarterly bulletin contains 52 pages of tables and consists of ten sections: 1. General Characteristics of Credit Organizations; 2. Assets; 3. Liabilities; 4. Capital; 5. Profits/Losses; 6. Standard Indicators; 7. Capitalization; 8. Profitability and 9, 10. Aggregate Indicators of Effectiveness of Armenian Credit Organizations’ Activities.

To see this bulletin and other information products of ARKA News Agency you should contact the agency’s marketing unit by e-mail: [email protected]. -0-

Read the news first and discuss them in our Telegram

Tags: