23.04.2012 16:20

YEREVAN, April 23. /ARKA/. Quotes for precious metals were under the pressure last week. Prices for gold lowered due to U.S. dollar’s strengthening and growing concerns on the situations at European credit markets. Yield of Spain’s government bonds with ten-year maturity period gained 6.15% for the first time after the first program on liquidity provision by the European regulator had been implemented.

Significant tumble in prices for gold were reported on Wednesday, April 18, due to the situation in Spain and Italy. The published data showed that problematic credits of Spain made up 8.7% in February against 7.91 % in January. Moreover, weak economic perspectives may force Italian government to defer budget balancing plan for a year that was projected for 2013. Relatively weak data coming from U.S. technological sector also influenced the sentiments of investors.

Spanish long-term bond auction was in the spotlight of market participants on Thursday, April 19. However, the outcomes did not significantly support the metal quotes. Spain auctioned 2.54-billion-euro worth bonds, that is a little higher of the targeted range, however, yield of bonds with ten-year maturity period jumped to 5.74 % versus 5.40 % earlier.

The auction outcomes first inspired the investors, however, yield growth of the bonds upset them later thus provoking gold sale.

At the end of the week quotes for gold could partially recover the losses due to weak economic statistics from the USA. The prices were also impacted by positive German data on business sentiments. As a result, gold prices lowered by 0.91% to 1,642.84 U.S. dollars per troy ounce last week.

Early next week the gold prices will depend on results of “Big Twenty’s” session and meeting of International Monetary Fund and World Bank on the weekend. If the sides reach agreement that “Big Twenty” will allocate significant amount of money for IMF aid programs, the precious metal prices may go up.

Nevertheless, the prices for gold next week will mainly depend on U.S. Federal Reserve’s regular session on interest rate and a press conference of American regulator head Mr. Bernanke, scheduled for Wednesday, April 25. The previously published protocol from the session somehow worsened gold perspectives. However, due to the recent weak data from labor market the regulator may change its position on the necessity of applying for the third phase of economy stimulation. This fact can have a positive impact on gold prices. Resistance level for gold can be 1,680.0 USD per troy ounce for next 5 trading days.

Macroeconomic statistics from the USA and euro zone may also influence the god prices next week. From American news we should highlight data on consumer trust index in April, housing market tendencies and orders for durable goods in March, as well as preliminary U.S. GDP for the first quarter. If this statistics appears worse than expected, soft monetary and credit policy will continue.

From European news we should attach attention to preliminary data on purchasing managers index for the euro zone manufacturing sector and consumer inflation in Germany for April. The expected moderately positive statistics will also foster sentiment rise at gold market. If the data from overseas is better than expected and euro zone reports negatively, prices for gold may go down. Point of 1,612.0 USD per troy ounce will be supporting for gold for the next five trading days.

Copper prices at the futures markets advanced 2.06% to 3.6910 USD per copper pound last week due to positive economic data from Germany. Indeed, index of economic expectations published by ZEW institute on Tuesday, April 17, increased to 23.4 in April against 22.3 from a month earlier, meanwhile many experts expected slip in the index to 19.0. Sentiment index in business sector of Germany published by IFO institute on Friday, April 20, also climbed to 109.9 points versus 109.8 points in March.

Expectations for possible mitigation in monetary and credit policy of China in several few days also fostered improving sentiments at the metal market.

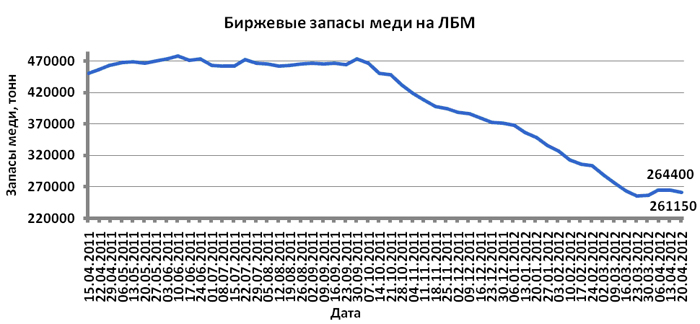

Lowered stock reserve of this asset in London Metal Exchange (LME) last week also impacted the copper prices.

Next week copper dynamics will mainly depend on U.S. and euro zone statistics as well as USD dynamics. This statistics is expected to be moderately positive. If the expectations come true, and data on U.S. first-quarter GDP and on purchasing managers index for the euro zone manufacturing sector appear favorable as well as Bernanke’s comments are moderately positive, prices for non-ferrous metals, including copper, may continue rising.

However, if this statistics doesn’t justify the hopes, and American dollar starts growing again, the copper prices may tumble. Anticipated fluctuation range of copper quotes on the futures market is 3.56 – 3.83 USD per copper pound coming week.

Mikael Verdyan, an analyst at FOREX CLUB, specially for ARKA news agency.

The opinion of the author does not necessarily reflect that of the agency. -0-

Read the news first and discuss them in our Telegram

Tags: