14.05.2012 12:38

YEREVAN, May 14. /ARKA/. Last week, the average exchange rate of U.S. dollar at NASDAQ OMX Armenia stock exchange rose by 0.54% to 394.47 drams with overall trading amounting to 11.45 million U.S. dollars, which was three times more from the previous week. The average selling rate of cash dollar rose by 0.57% to 395.74 drams on May 12.

Stable rising of the U.S. currency in Armenia last week was due to persisting demand of the investors and population for foreign currency, as well as to the ongoing appreciation of the U.S. dollar at international currency markets.

This week, due to possible ongoing strengthening of the U.S. currency at global markets and amid the ongoing domestic demand, the U.S. dollar is likely to continue growing to 395.50 drams in Armenia.

However, the ongoing U.S. dollar’s strengthening may be hindered by the regulator’s policy to enter trades in order to support the national currency from sharper depreciation.

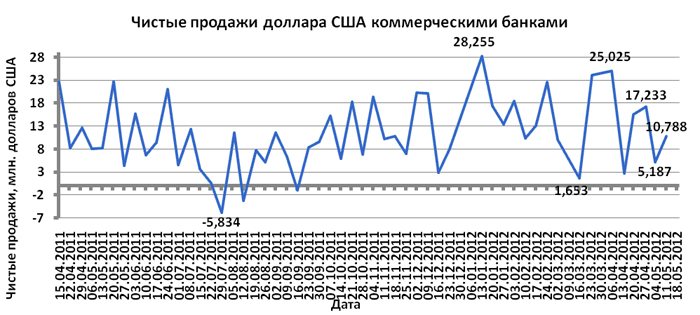

According to the Central Bank of Armenia review, a total of $10.788 million were sold at intra-banking exchange market by commercial banks last week, which was two times more than the previous week. Thus, the average selling rate of cash U.S. dollar in Armenia this week will likely be between 394 – 397 drams.

The euro exchange rate in Armenia last week was determined by events at global currency markets, where the EUR/USD fell by 1.28% to 1.2915. The pair was seriously impacted by unsatisfactory presidential results from France and parliamentary elections in Greece. The constituents of these countries voted against austerity measures unleashing concerns related to euro zone’s budget consolidation plan implementation and decreasing attractiveness of the European currency.

At the same time, the ongoing issues connected with the government bonds of Spain and Italy raise the risks of euro zone’s incapability to deal with its debts. As a result, average selling rate of euro cash in Armenia dropped by 0.93% to 514.26 drams last week.

This week, the political unrest in the euro zone may go on with pressing euro. Euro dynamics will be also impacted by economic data from the USA and euro zone.

Of American news we should highlight data on industrial production, consumer inflation and numbers from housing market in April, as well as protocol publication from the last U.S. Federal Reserve’s session, April 24-25. If the statistics appears to be unsatisfactory and there is a need for new measures to stimulate economy, euro may receive a significant impetus for rising.

Of European news we should focus on consumer inflation in April and ZEW’s publication on German business sentiments index in May, as well as preliminary GDP figures in the euro zone for the first quarter. The expected weak economic statistics from the region will continue pressing euro quotes.

At the same time, if data coming from the USA is very positive, this may give food for new concerns around tightening credit policy of U.S. Federal Reserve and strengthen the U.S. currency.

In the coming week the expected fluctuation range of euro at FOREX market will be within 1.2800-1.3050. The average selling rate of euro cash in Armenia this week will be within 505 – 525 drams.

The average selling rate of the Russian ruble fell by 0.75 % to 13.15 drams for the previous week due to decrease in the ruble’s value against USD touched off by the elections in France and Greece as well as oil prices tumbles.

The cost of the ruble against the U.S. dollar and, consequently, the dram this week will depend on the emerging macroeconomic statistics from the U.S. and the euro zone, as well as the dynamics of oil prices. Deteriorated political backdrop caused by the elections in the euro zone, and weak data from Europe may push ruble to further falling. However, if economic data from overseas appear moderately positive, and from euro zone- satisfactory despite pessimistic projections, ruble may advance. The average selling rate of the cash ruble in Armenia over the next five trading days is likely to be in the range of 13.05 – 13.25 drams.

Mikael Verdyan, analyst at GK FOREX CLUB, specially for ARKA

The opinion of the author may not necessarily reflect the opinion of ARKA. —0--

Read the news first and discuss them in our Telegram

Tags: