29.05.2012 12:25

YEREVAN, May 29. /ARKA/. Gold prices saw upturn last week due to stabilization of sentiments at commodity assets market. The relative stabilization in sentiments was touched off by the G8 summit held last weekend. In spite of the fact that the G8 countries didn’t manage to agree on measures to counter the debt crisis in the euro zone, they all expressed the willingness to see Greece within the euro zone. Moreover, the leaders released a statement related to undertaking measures to enhance the economy.

However, from May 22, Tuesday, to this mid-week the sentiments of the market members deteriorated again inciting the yellow metal’s sales. This negative aspect was prompted by the concerns around perspectives of Greece to stay within the euro zone and possible consequences if the country exists the currency bloc. The unexpected statement made by Greece’s former prime-minister that his state is getting ready to leave the euro zone just aggravated nervousness in the markets. The results of the non-official EU states summit didn’t bring any optimism either.

Nevertheless, quotes for gold managed to recover the losses partially later last week, due to some optimistic U.S. economic data and rise at the European markets. The stabilization of the principal currency pair has also limited demand for dollar as a currency-asylum. The fact that the central banks of a number of states continued increasing gold reserves in April and May has also improved the sentiments of the investors.

As a result, gold prices dropped by 1.94 % to 1,562.13 USD per troy ounce.

On the coming week, gold prices may face a slight increase or consolidation, however to make the dynamics steadily growing it is required to renew steady investment and physical demand. The principal risks for fall in gold prices are still coming from the euro zone due to uncertainty around the situation in the region. Strong U.S. dollar will also make the quotes tumble.

The forecasted macroeconomic statistics from the United States and the euro zone may also influence the dynamics of the precious metal on the coming week. Of the American data we should focus on the purchasing managers index (PMI), the number of new jobs announced by ADP agency and the change in the number of non-agricultural employees in May, as well as the reviewed first-quarter GDP of this year. Of the European news we should highlight the publication of the composite PMI index in May. The expected moderately positive statistics from overseas may support the quotes for gold. The resistance level for gold next week may be 1,610.0 USD per troy ounce.

Nevertheless, very optimistic data from the United States may provoke new concerns around another program of the Federal Reserve to stimulate the economy, and this can enhance the U.S. dollar thus decreasing gold prices. The supporting point for the gold within the next five days will be 1,533.0 USD per troy ounce.

Copper prices last week reported 3.457 USD per pound. Earlier last week the prices went up due to comments made by Chinese officials, particularly, the prime minister Wen Jiabao who said the measures against economic recession will play great role for the Chinese authorities. However, the copper quotes were pressured by the concerns around Greece, as well as banking situation in Spain and strong U.S. dollar.

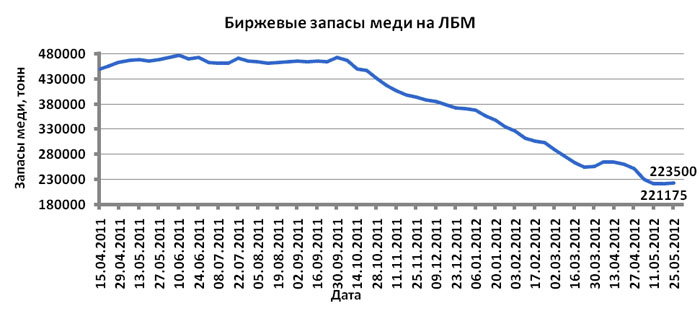

Slightly increased stock reserve of this asset in London Metal Exchange (LME) prevented the quotes from rising last week.

Next week copper dynamics will mainly depend on U.S. and Chinese macroeconomic statistics as well as U.S. dollar’s dynamics. U.S. and China’s GDP as well as PMI index are expected to drop. In this case quotes for copper may slip.

However, if this statistics is satisfactory, the data from the U.S. labor market are moderately positive, non-ferrous metals, including copper, will gain an impetus for growing. Anticipated fluctuation range of copper quotes on the futures market is 3.32 – 3.57 USD per copper pound coming week.

Mikael Verdyan, an analyst at FOREX CLUB, specially for ARKA news agency.

The opinion of the author does not necessarily reflect that of the agency.—0–

Read the news first and discuss them in our Telegram

Tags: