02.07.2012 15:54

YEREVAN, July 2. /ARKA/. On the first day of the last trading week gold prices rose as the USA issued weak economic data, what, in turn, inspired the market members that the American regulator may turn to the new stimulation measures.

Indeed, economic activity index by Federal Reserve of Chicago dropped to 0.45 in May from 0.08 in April thus signaling about ongoing slowdown in economic growth of the United States.

Nevertheless, from Tuesday to Thursday gold quotes start tumbling as sentiments of the investors deteriorated again. This was due to the waiting position taken by the investors on the eve of the EU summit. The investors are really skeptical about the drastic measures that can be undertaken by the EU leaders on the summit to find a solution to the debt crisis. This, in turn, prevented gold prices from rising. The number of negative news from Europe continued increasing thus implying that the EU leaders will have very tough discussions.

However, at the end of the week, on June 29, gold prices climbed sharply. It was touched off by the news that stabilizing funds of Europe may be involved into the processes of enhancing debt markets of the troubled states, without necessity to introduce additional austerity measures for economy. At the same time, European Financial Stability Fund will be authorized to carry out recapitalization of the European banks directly. This will allow to support the troubled banks without increasing the debt of a government. Also according to the signed pact, the European Union will allocate 120 billion euros for stimulation of economic growth and employment in the region. As a result the gold prices jumped by 1.77% to 1,597.27 USD per troy ounce.

This week gold may continue advancing if EU leaders appear with positive results after the summit. However, this support, according to our assessments, will have a short-term effect, as restoration of the dynamics requires individuals’ and investment demand. Hereby, even if the beginning of the week appears as optimistic for gold, its quotes may drop due to profit fixation.

Gold dynamics will also depend on the macroeconomic data from the U.S. and euro zone. Of American news we should focus on the purchasing managers’ index in industry and service sphere issued by Institute of Supply Management, as well as employment rate by ADP agency and a number of new vacancies in non-agricultural sector in June. Data from labor market is expected to be positive, and it will pressure the precious metal quotes. Thus the supporting benchmark for gold quotes may be 1,550.0 USD per troy ounce.

Of European news we should highlight another meeting of ECB on interest rate, scheduled for Thursday, July 5. The European regulator is expected to downgrade the rate by 0.25% to 0.75%. If these forecasts are justified, and economic statistics from overseas is negative, gold prices may continue boosting.

Thus over the next five days gold prices may fetch up 1,645.0 USD per troy ounce.

The cost of copper futures last week increased by 5.87% to 3.4985 USD per pound. Copper prices rose sharply on Friday as the investors were inspired by the progress signs in a struggle against the banking crisis of Europe.

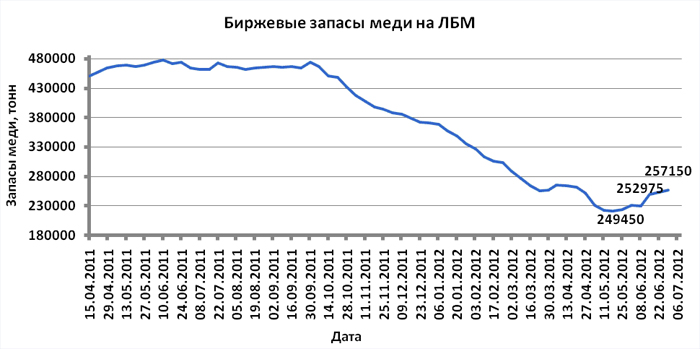

The increased stock reserve of this asset in London Metal Exchange (LME) prevented the quotes from climbing last week.

This week copper dynamics will mainly depend on macroeconomic statistics from the United States, China and the euro zone. The U.S. statistics is expected to be moderately positive. If these forecasts are justified, and the data from the labor market are moderately positive, non-ferrous metals, including copper, may continue rising in price. The quotes may get an additional impetus if June’s PMI from HSBC of China will be better than expected.

Of European news we should highlight the results of a regular ECB meeting. If the European regulator undertakes additional measures for softening credit and monetary policy, copper quotes may increase. However, if the results are negative, and the U.S. statistics is worse than expected copper prices will turn to dropping.

The anticipated fluctuation range of copper quotes on the futures market will be 3.40 – 3.60 USD per copper pound this week.

Mikael Verdyan, an analyst at FOREX CLUB, specially for ARKA news agency.

The opinion of the author does not necessarily reflect that of the agency. —0–

Read the news first and discuss them in our Telegram

Tags: