14.08.2012 15:15

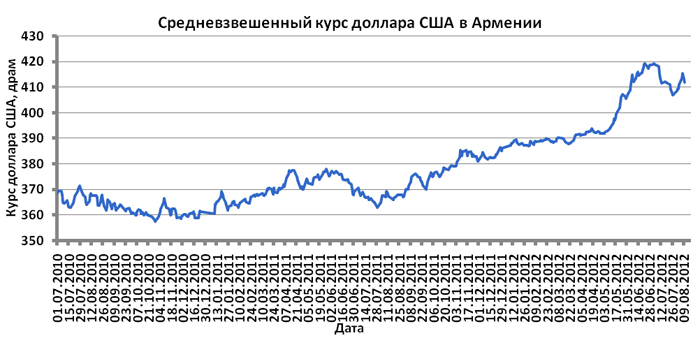

YEREVAN, August 14. /ARKA/. Last week the U.S. dollar’s average weighted exchange rate at NASDAQ OMX Armenia stock exchange rose by 0.22 % to 411.92 drams with weekly trading amounting to USD 12.20 million, 96. 77% higher from a week earlier. The average selling rate of cash dollar increased by 0.17% to 414.0 drams as of Saturday, August 11.

Early last week the average weighted exchange rate of the American currency was actively growing due to high demand for USD demonstrated by importers and the population of the country.

Armenian CB decision to leave the interest rates unchanged at 8.0% has also pressured the Armenian dram.

However, later that week dram partially rallied due to the revenue fixation.

This week the U.S. dollar may continue growing amid the possible strong positions in the world. The resistance level for average weighted USD exchange rate at NASDAQ OMX Armenia may be 415.0 drams. Nevertheless, the national regulator may intervene into the trades to support the Armenian dram from further devaluation.

Hereby, we can forecast average weighted selling rate of cash dollar will be within 412-417 drams in Armenia this week.

Euro rates in Armenia depended on FOREX market, where EUR/USD slipped by 0.78% to 1.2288.

Last week the principal currency pair faced pressure after it had tested the resistance within 1.2440 unsuccessfully due to ECB comments about the possible intervention into the tensed bond situation in Spain and Italy.

However, weak economic data on industrial production coming from the leading economies of the Eurozone furthermore pressured the European currency. At the same time the ongoing shocks at the bond market of the peripheral to the region countries cast doubts on Europe’s capability to solve its debt problems. As a result an average weighted selling rate of euro cash in Armenia dropped by 0.52% to 507.50 drams last week.

Euro dynamics will mainly depend on economic data from the USA and the Eurozone this week.

Of American news we should highlight industrial production, consumer inflation, housing market, as well as the number of long-term American securities bought by foreign investors in June. If this statistics is unsatisfactory, euro may gain an impetus for growing. Of European news we should focus on consumer inflation in July and business sentiment index in Germany by ZEW institute in August, as well as preliminary data on Eurozone’s GDP in the second quarter. The weak economic statistics from the region will continue pressuring euro rates.

At the same time, very optimistic data from the U.S. may trigger USD growth. The expected euro fluctuation range at FOREX in Armenia this week will be 1.2130-1.2400. The average selling rate of cash euro in Armenia this week will likely be in the range of 500 – 515 drams.

The average selling rate of cash Russian ruble last week climbed by 0.47% to 13.05 drams due to ruble’s increase against USD amid oil prices upturn.

The cost of ruble against USD this week will be depending on U.S. macroeconomic statistics and Eurozone, as well as oil prices dynamics. The expected weak data from Europe may weaken the ruble’s positions.

The average selling rate of the ruble in Armenia is likely to be in the range of 12.95 – 13.15 drams.

Mikael Verdyan, an analyst for FOREX CLUB, specially for ARKA.

The opinion of the author may not necessarily represent those of the agency. —0-

Read the news first and discuss them in our Telegram

Tags: