22.10.2012 19:16

YEREVAN, October 22. /ARKA/. Last week quotes for precious assets, including gold, significantly slashed amid the U.S. strengthening. As a result, gold quotes reached a new five-week minimum of 1,716.71 USD per troy ounce. The new concerns about the situation in Europe after discouraging statement by Germany’s Chancellor Mrs Merkel also forced the investors to buy the U.S. currency, as an asylum currency.

Nevertheless, mid-week, the hopes around Spain’s readiness to apply for financial aid created some favorable conditions for hike in gold quotes. Positive economic statistics from Germany also encouraged the investors. Indeed, according to ZEW institute, business sentiment index increased to -11,5 in October against -18.2 in September. However, the weakened euphoria around stimuli measures, and the ongoing weak physical demand from India, the largest gold consumer, due to rupee devaluation continue pressuring gold quotes. Eventually, gold cost dived by 1.84% to 1721.35 USD per troy ounce.

This week, gold quotes are likely to face pressure again amid the uncertain situation in Europe. The situation is deteriorated by inability of the EU leaders to present any solutions to debt crisis to international investors following the summit in Brussels. Meanwhile, Spain continues deferring applying for the full-scale financial aid. Strong positions of the USD will also deter gold quotes from rising. The supporting benchmark for gold will be 1,700.0 USD per troy ounce.

Gold dynamics will depend on the projected macroeconomic statistics from the USA and eurozone. Of the American news we should focus on the U.S. housing market indicators, orders on items for long use in September, and the final indicator of confidence by Michigan university in October, as well as preliminary GDP index in the third quarter. If this statistics is better than expected, gold prices may fall.

Nevertheless, the most important event, which can significantly influence the gold, will be another meeting related to interest rate of the U.S. Federal Reserve, and its chairman Mr. Bernanke’s press briefing, October 24. We anticipate Mr. Bernanke’s comments to be neutral, that will have a good impact on gold prices, in turn. However, gold quotes may drop if the economic forecasts are positive.

Of the European news we should highlight the publication of the preliminary data on PMI for manufacture sector of the eurozone, and October’s business atmosphere condition index in Germany by IFO. The expected moderately positive statistics will prompt hikes in gold prices. The resistance level for gold in the next five days may be 1,745.0 USD per troy ounce.

Copper cost slashed by 0.64% to 3.6315 USD per copper pound due to strong USD. Weak economic data on GDP and retail sales in China, which actually met the expectations, didn’t support the quotes.

Optimistic business sentiment index of Germany, however, fostered rise in copper quotes. Optimistic data on China’s foreign trade also encouraged hike in this asset.

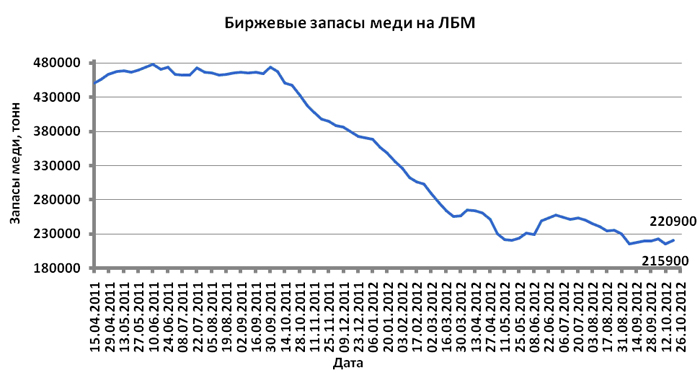

The increased reserve of this asset at London Metal Exchange also had deterred copper from rising.

This week copper dynamics will mainly depend on the macroeconomic data of the United States, eurozone and USD. If the data are optimistic, the copper quotes will go up.

October’s business activity index in manufacture in China by HSBC is also expected to be published this week.

The projected weak statistics may cause sales of copper quotes. The expected fluctuation range for copper prices is 3,57 – 3,70 USD per pound.—0-

Mikael Verdyan, an analyst at FOREX CLUB, specially for ARKA news agency.

The opinion of the author does not necessarily reflect that of the agency.

Read the news first and discuss them in our Telegram

Tags: