05.11.2012 17:44

YEREVAN, November 5. /ARKA/. The investors abstained from making big deals early last week as Sandy hurricane hit New York forcing the Wall Street to close from Monday to Wednesday.

Nevertheless, gold prices slightly rose as the American market participants resumed their activity. Favorable data on Germany’s retail sales gave an optimistic impetus to the investors. A slightly disappointing PMI from Chicago also fostered the gold quotes hike.

However, very optimistic data from the U.S. labor market reduced gold prices on the final day of the trading week. As a result, gold prices reached a new nine-day minimum of 1,674.22 USD per troy ounce. Indeed, the number of new jobs in a non-agricultural sector rose by 171,000 in October versus the projected 124,000. Pretty positive data from the U.S. labor market raised concerns over the third round of the quantitative easing by the American regulator. Amid this, gold prices fell 2.14% to 1,677.32 USD per troy ounce.

This week, gold quotes will remain vulnerable due to the strong USD. The current uncertain situation around the eurozone can also have a negative impact on the gold cost. The main event expected to influence the gold quotes is the U.S. presidential elections. The supporting point for the gold will be 1,650.0 USD per troy ounce this week.

Gold dynamics will also depend on the planned macroeconomic statistics from the U.S. and eurozone. Of the American news we should focus on October services PMI by the Institute for Supply Management, the preliminary confidence indicator by University of Michigan in November, and the initial number of unemployment allowance application over the last week. If the statistics is again better than expected, gold quotes may tumble.

Of the European news we should highlight composite PMI and October consumer prices index in Germany, the regular meeting of the ECB on the interest rate, and the press conference of ECB chairman Mr Draghi scheduled for November 8, Thursday. We believe the European regulator will not make any surprising decisions related to the monetary policy. The expected moderately positive statistics from the eurozone will also improve the sentiments at the metal market. The gold prices may reach 1,700.0 USD per troy ounce within the next five days.

Copper price slipped 1.90% to 3.4820 USD per pound last week due to stock index drop and the strong USD. The highest tumble was recorded last Monday and Friday. The upcoming U.S. presidential elections and the 18th congress of China’s Communist Party also fostered drop in copper quotes.

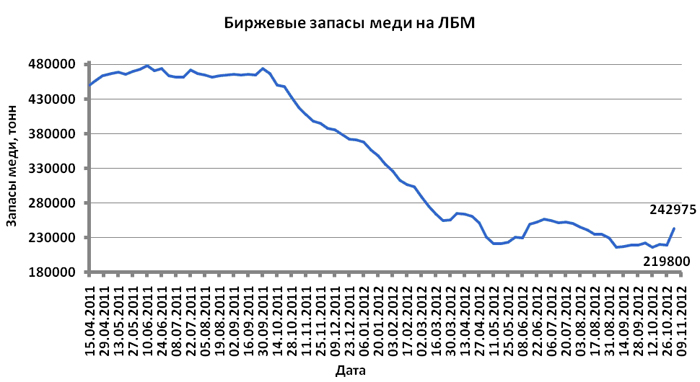

Nevertheless, copper prices rose, however, as the principal currency pair enhanced its positions. The increased reserve of this asset at London Metal Exchange also pressured copper quotes.

This week copper dynamics will mainly depend on the macroeconomic statistics of the United States, eurozone and China, as well as the USD. Preliminary inflation rates, data on industrial production and foreign trade of China in October will also define the copper quotes.

If the projected statistics is negative, and the American currency continue growing, copper cost will fall. The expected fluctuation range for copper prices is 3.40 – 3.57 USD per pound.

Mikael Verdyan, an analyst at FOREX CLUB, specially for ARKA news agency.

The opinion of the author does not necessarily reflect that of the agency. E.O.—0-

Read the news first and discuss them in our Telegram

Tags: