11.03.2013 13:00

YEREVAN, March 11. /ARKA/. The prices for gold were teetering during the past five trading days amid the curbed activity of investors and concerns around the U.S. budget sequester. In addition, strong USD and no data which could influence the quotes brought up no optimism as well.

The U.S. stock exchange rally continued damping interest to this asset. However, optimistic statistics from the U.S. labor market appeared as the main catalyst of gold sales at the end of the week. This, in turn, raised concerns around the duration of stimulus measures. The number of new jobs in a non-agricultural sector of the USA rose by 236,000 versus the forecasted 165,000, and the unemployment rate dropped to 7.7% against 7.9% last month.

In the end, the gold cost dove by 0.09% to 1,577.77 USD per troy ounce last week.

This week the gold quotes are likely to be falling amid some better macroeconomic conditions in the world and investors being more prone to risky deals. Moreover, the investors will not relax as long as they face the ongoing outflow of the means from stock exchanges markets focusing on metals and the uncertain situation around the duration of stimulus measures implemented by the American regulator. Though, we don’t exclude the scenario of consolidation. The resistance benchmark this week may be 1,604.0 USD per troy ounce.

At the same time, gold prices are still pressured. Meanwhile, the gold is likely to be traded within 1,524.0 – 1,630.0 USD per troy ounce over the upcoming several months.

This week the gold dynamics will mainly depend on the U.S. and eurozone macroeconomic statistics. Of the American news we should focus on the retail trade statistics, consumer price index, industrial output for February, preliminary confidence index from University of Michigan for March and the number of primary unemployment allowance applications for the past week. Of the European news we should highlight consumer inflation rates for February and the monthly report by the ECB. We expect some moderately positive statistics from overseas and weak data from the eurozone will pressure the gold quotes. The supporting benchmark for gold may be 1,546.0 USD per troy ounce.

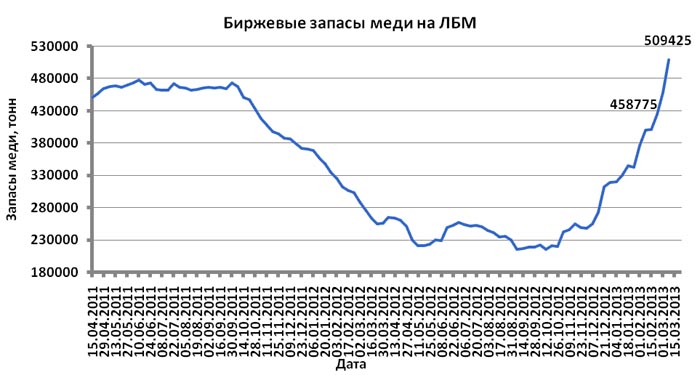

Copper prices shot up by 0.16% to 3.5110 USD per pound. Nevertheless, there was no definite tendencies for this metal’s trading. Copper prices slightly rose early last week to week highs of 3.5415 USD per pound due to circumspect purchases at low prices and statements of China’s PM Wen Jiabao who confirmed the target level of economic growth at 7.5% this year.

However, USD dynamics cut the prices for copper. At the same time, increased reserve of this asset at London Metal Exchange also prevented jump in copper quotes.

This week copper quotes will be pressured amid the curbed activity of the investors as a result of weak data from China. Indeed, industrial output statistics, published on March 9, data on retail sales and consumer inflation proved the reduced demand for copper of the world major copper consumer.

Copper dynamics will also depend on the data from overseas. If the statistics is worse than expected, the copper quotes may tumble. The anticipated fluctuation range for copper quotes this week will be 3.42 – 3.58 USD per pound.

Mikael Verdyan, an analyst at FOREX CLUB, specially for ARKA news agency.

The opinion of the author does not necessarily reflect that of the agency.—0-

Read the news first and discuss them in our Telegram

Tags: