03.06.2013 15:09

YEREVAN, June 3./ARKA/. Gold prices were mostly climbing last week, however, no definite dynamics was reported. The highest increase was demonstrated in the middle of the week after the USA released its macroeconomic statistics which highlighted US economic slowdown. According to the statistics, the U.S. GDP in the first quarter rose by 2.4% whereas last month it was anticipated at 2.5%. Moreover, weaker than expected labor statistics from America drove the investors to calm down around the quantitative stimulus program terms.

Gold quotes got also support from weaker USD against its main competitors, because the gold prices in USD are more attractive for those who use foreign currency. Hereby, the gold quotes jumped to 1,421.76 USD per troy ounce, which is a record high point over the last two weeks.

Nevertheless, the gold quotes got pressured at the end of the week amid increasing demand for higher-yielding assets. As a result, the gold prices reached 1,386.74 USD per troy ounce, almost the same as a week earlier.

This week, the gold quotes are likely to consolidate or tumble as the investors will be digesting contradictory macroeconomic statistics from the largest economy. In addition, weak price risks and better macroeconomic statistics also reduce short-term and medium-term demand for this asset as a tool for hedging risks from inflation and paper money weakening.

Gold dynamics will mainly depend on macroeconomic statistics from America and eurozone. Of the American news, we should focus on PMI from Institute for Supply Management, the number of new jobs from ADP agency and the number of the employed in non-agricultural sector for May. The expected moderately positive statistics from overseas will indicate that the American regulator can start screwing its asset purchase program in the near future; as a result, the gold quotes may down.

Of the European news, we should highlight the final PMI for May and retail trade for April, 1Q GDP of the eurozone. Among the important events, it is also important to highlight another meeting of the ECB on a principal interest rate, and the traditional press conference of its chairman Mario Draghi. The regulator is expected to leave the rate unchanged at 0.50%. If these forecasts come true, and the comments of Mr. Draghi are moderately positive, the gold cost is likely to jump. The resistance benchmark may be 1,428.0 USD per troy ounce this week.

According to the technical analyses, the medium-term gold perspectives remain vulnerable, thus we believe this asset has space for falling. Nevertheless, short-term perspectives seem to be much better while the gold price is higher than 1,373.51 USD per troy ounce. Tumbles in the quotes lower than the supporting benchmark will raise doubts around short-term positive perspectives.

Copper cost last week downed by 0.88% to 3.2720 USD per pound as the investors received contradictory macro-statistics from the USA. Concerns around the global economy were also pressuring the quotes.

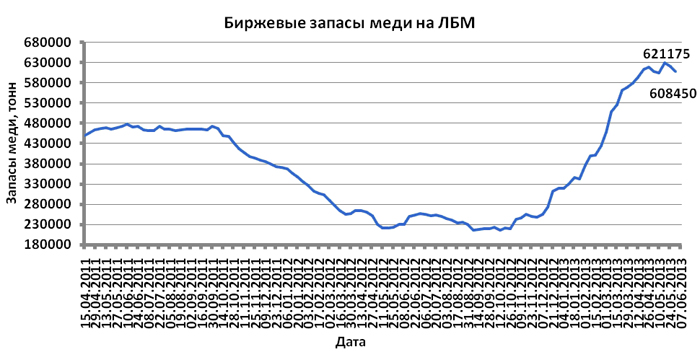

Another driver for downturn was the increased reserve of this asset at Shanghai Futures Exchange. Reserves of this asset at Shanghai Futures Exchange rose by 2693 thousand tons to 179317 thousand tons. Nevertheless, the decreased reserve of this asset at London Metal Exchange drove hikes in copper quotes.

Positive U.S. labor statistics can also increase copper quotes. Of the Chinese news, we should highlight foreign trade and business activity index in industry by HSBC for May.

If the U.S. statistics is worse than expected, and the Chinese data demonstrate negative dynamics, copper cost may dive.

Copper prices may vary within 3.15-3.35 USD per pound this week.

Mikael Verdyan, an analyst at FOREX CLUB, specially for ARKA news agency.

The opinion of the author does not necessarily reflect that of the agency.—0-

Read the news first and discuss them in our Telegram

Tags: