25.09.2015 20:51

Exclusive Interview of Hasmik Nersisyan, the Chief of Areximbank-Gazprombank Group CJSC's IT department, with ARKA News Agency

According to statistical reports, clients can make more than 80% of all their banking transactions without visiting banks. Today the fast growing competition prompts the necessity of improvement and replenishment of active services. Mobile banking is the most interesting service among new services. What does it offer to clients? How does it solve the information security problem? Hasmik Nersisyan is answering these and other questions.

ARKA – Just recently Areximbank-Gazprombank Group released ArexiMobile, a free mobile application for users of remote banking services. What is this and how to use it?

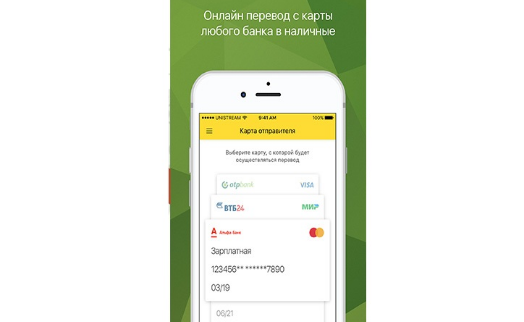

Nersisyan – ArexiMobile App allows individuals and corporate clients to manage their accounts throughout 24 hours a day, to pay their utility bills, transfer money, convert currencies, make payments on administrative acts and to see their deposits and loans as well as schemes of repayment of their loans. Besides, ArexiMobile allows synchronizing their loan repayment schedules with a mobile calendar. The app users can also receive notes on loan payment days. The application has an extra option which makes it possible to identify location of the nearest branch of Areximbank, ATM or trade center with its Pos Terminal. Both resident and nonresident clients may use this option. They may also get information about Areximbank products in 24/7 format in any spot of the world. The app is fit for iOS and Android, from which it can be downloaded for free. Prices for this service are in conformity with prices for Areximbank's Internet banking services.

ARKA – Your bank has been offering Internet banking service to its clients for so long now. What is the reason for adding mobile banking to it, what is the difference between them?

Nersisyan – Areximbank started providing its Internet banking service in November 2009. Now more than 1,600 clients enjoy this service. Of course, they are not so many, but, taking into account a very severe competition among banks, we find this result more than good. I would like to speak a little about an interesting study aimed at gauging effectiveness of Internet banking service and identifying categories of its potential users. Our annual surveys conducted on the bank's website showed the following results: the majority of the service consumers are corporate clients – firms and organizations. Among individuals, young people aged from 20 to 35 who reside in Yerevan, mostly men, dominate. The most of the surveyed clients keep watch on their accounts and make payment orders. Speaking about Internet banking advantages over the real office, the respondents were unanimous in saying that it saves time and it is available 24 hours a day in every spot in the world.

There is also one remarkable detail. Internet banking service was rated at 5 on a five-grade scale this year, while in the previous year this service was rated at 4.

As for the second part of your question, mobile banking and Internet banking are not the same things. Mobile banking is a logical continuation of Internet banking. You were right in saying that to withstand the fast-growing competition banks have to improve their products constantly adding new services to already existing ranges. Mobile banking is singled out today among other new services. Internet banking makes it possible to manage accounts via computers, while its mobile version extends this opportunity allowing users to do the same via tablets and personal smartphones. Technologically mobile banking doesn't differ from Internet banking, but it has one important merit – it is available always and everywhere.

ARKA – And then what should those clients who already use Internet banking do?

Nersisyan – Such clients should do nothing but to visit Apple Store or Google Play, download the application and enjoy mobile banking service.

ARKA – You mentioned a severe competition among banks in this segment of the market. And what is that?

Nersisyan – Indeed, competition in this market is very severe – there is struggle for each client. The thing is that banks offer the same range of services, conditions and prices. The only difference is quality and speed of the services as well as commercial offers that are constantly being updated. Management of accounts, payment of bills, money transfers are in the highest demand now, and apps serve them excellently.

They may differ only by convenience of interfaces and amplitude of capacity. That is why development of a good application is one of the bank's top-priority objectives. Indeed, the more opportunities enjoyed by clients for managing money via interface the more frequent their usage of the bank's services.

Clients, especially young people, consider mobile banking services as one of the most important criteria in choosing a servicing bank. Therefore, mobile banking has become one of our priorities.

ARKA – And another important matter is security. Do you guarantee it?

Nersisyan – Security is the main matter. Hacker technologies are developing along with development of technologies. The new product undergoes many security tests. First are Apple Store or Google tests. Our product will not be accepted by them unless it meets their security requirements. The bank, on its side, provides additional protection means, so-called token, which generates a set of figures every second. In carrying out a certain transaction, a client presses the token and it releases a particular set of figures, an additional password, which is used by the client instead of electronic signature.

And clients' responsibility is the most important thing – clients should reveal their logins and passwords to nobody. They also shouldn't give their phones to anybody. We have great expectations from mobile banking, especially in terms of inflow of new clients – students and young people working at offices.

They are the most active users of gadgets and they welcome every novelty. The other category is heads of companies and business people who travel much and have frequent business trips. I am convinced they will appreciate our app.

Remarkable is that some clients showed interest in it yet while testing was under way. We received many calls – people asked when the app would become available. And time has come. Now we are offering our product, which, I sure, will become popular and later commonplace in our clients' lives. Its introduction is important not only to our bank, but also to Armenia, since this is another step toward distant banking development in our country. --0--

Read the news first and discuss them in our Telegram

Tags: