18.06.2012 19:17

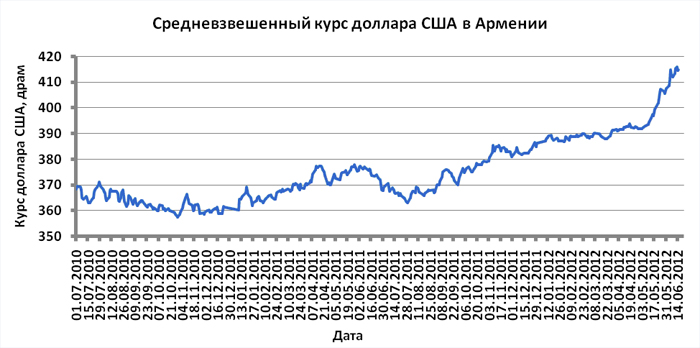

YEREVAN, June 18. /ARKA/. Last week the USD at NASDAQ OMX Armenia stock exchange climbed by 0.66% to 414.82 drams as overall weekly trading amounted to 15.0 million drams, 55.61% less from the previous week.

Last week the USD at NASDAQ OMX Armenia stock exchange climbed by 0.66% to 414.82 drams as overall weekly trading amounted to 15.0 million drams, 55.61% less from the previous week.

The average selling rate of cash greenback jumped by 0.70% to 416.79 drams on June 15, Saturday.

Over the last trading week an average weighted rate of the U.S. currency continued growing thus reaching the new recording point since mid-July of 2006 to 416.00 drams. This was prompted by uncertain situation around the euro zone and banking system of Spain, that shored up continuing demand of the investors and population for the U.S. dollar. Strong USD at FOREX market is also raising demand in Armenia for this currency.

We suppose that the U.S. dynamics in Armenia will mainly depend on parliamentary elections in Greece. If radically left Syriza party wins, tensions at the global financial markets will somehow arise thus supporting USD growth either in the world as a whole or in Armenia. If the regulator enter trades to support the national currency, an average selling rate of USD cash will be within 414.0-420.0 drams this week.

American dollar’s rise will be also hindered the reduced volume of USD purchases by the population and business. Indeed, according to the Armenian Central Bank’s review, a total of 10.884 million dollars were sold at intra-banking exchange market by commercial banks last week, which was 62.97% less from the last week.

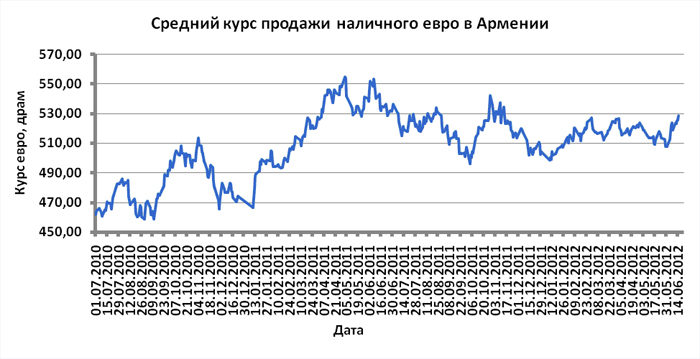

The euro exchange rate in Armenia last week was determined by events at FOREX global currency market, where EUR/USD pair jumped by 1.0% to 1.2640, as well as USD dynamics against the Armenian dram.

On the first day of the last trading week, euro was mostly falling as optimism around financial aid provided to Spain disappeared pretty soon. However, from Tuesday to the end of the week the sentiments of businessmen improved again inciting euro sales after the president of Federal Reserve Bank of Chicago Charles Evans said he supports softening monetary-credit policy in his interview on June 12.

Weaker than expected data on the U.S. economy also encouraged the investors that the Federal Reserve will announce on launching new measures directed to economy stimulation on June 20. Indeed, retail sales in May tumbled by 0.2% in the United States, and a number of unemployment allowance applications reached 386,0 thousand against projected 377,0 thousand.

Nevertheless, the investors were cautious on the eve of the parliamentary elections in Greece, and concerning the perspectives of Spain’s banking sector. The yield of ten-year Spanish debt securities increased to psychologically important benchmark of 7.0%, and the yield of Italian bonds reached 6.342%, new maximally high records.

As a result, an average selling rate of euro cash in Armenia climbed by 1.87% to 528.51 drams last week due to fall of AMD against USD.

Euro dynamics will depend on the news in the euro zone and results from the regular session of the U.S. Federal Reserve. Of European news we should focus on the results of the parliamentary elections in Greece. If New Democracy party wins, that supports the conditions of aid programs, and the U.S. Federal Reserve will meet the expectations of investors concerning new measures on economy stimulation, high-yield currencies, including euro, will get impetus for growing.

If the election results are unsatisfactory, and the decision made by the U.S. Federal Reserve related to economy stimulation is negative, euro will start dropping again. The expected euro fluctuation range at FOREX market will be 1.2300-1.2850 this week. The average selling rate of euro cash in Armenia this week will be within 515 – 540 drams.

The average selling rate of the Russian ruble surged by 2.28 % to 13.01 drams last week due to increase in the ruble’s value against USD touched off by partial resume in oil prices and Armenian dram devaluation against USD.

Ruble rates against USD and Armenian dram will depend on Greece’s parliamentary elections results. If New Democracy party wins and there will be real chances to form the Cabinet, the Russian currency may significantly jump. However, if left Syriza party gains the victory, ruble will continue falling.

The average selling rate of the cash ruble in Armenia over the next five trading days is likely to be in the range of 12.85 – 13.15 drams.

Mikael Verdyan, analyst at GK FOREX CLUB, specially for ARKA

The opinion of the author may not necessarily reflect the opinion of ARKA.—0

Read the news first and discuss them in our Telegram

Tags: