10.06.2013 14:02

YEREVAN, June 10./ARKA/. Gold prices demonstrated no definite dynamics over the past five days. Most of the time the investors were pretty restricted. Gold prices were pressured amid the concerns over the demand from the world largest gold consumer. The Reserve Bank of India went on activating measures to limit gold purchases banning the trading agents to import gold and delay the payments. It also rose the import tax from 6% to 8%.

Nevertheless, by the end of the week, the gold cost has climbed to record 3-week high 1,423.74 USD per troy ounce. Such growth was due to weaker USD which dropped amid the ECB meeting which ended up to be non-favorable for USD. As it was anticipated, the European regulator decided not to change its monetary –credit policy leaving the interest rate at 0.50%. The press conference of ECB chairman Mario Draghi raised a hurricane of emotions at the stock market though. The matter is that Draghi didn’t mention some negative interest rates for deposits or softer monetary policy. This, in turn pushed USD sales.

Overseas statistics instigated gold sales, however, at the end of the week raising concerns around stimulus program terms. The number of new vacancies in the U.S. non-agricultural sector increased by 175,000 in May versus anticipated 163,000. Unemployment rate jumped to 7.6% in May versus previous month’s 7.5%. Thus, gold prices fell by 0.81% to 1,382.92 USD per troy ounce.

This week, the gold dynamics will likely drop amid better US macroeconomic statistics and investors being more prone to take risks. Moreover, the ongoing outflow of means from the metal market funds and still uncertain terms of the stimulus program don’t allow the investors to relax. Even though we don’t deny the consolidation may happen.

The gold dynamics will depend on the US and eurozone macroeconomic statistics. Of the American news we should focus on retail trade, the producer price index and industrial output for May, preliminary confidence index by University of Michigan for June, and the number of the primary unemployment allowance applications for the last week. Of the European news we should highlight consumer inflation for May and monthly ECB report. Moderately positive statistics from overseas and weak one from eurozone will pressure gold quotes. The supporting benchmark for gold next week may be 1,350.0 per troy ounce.

However, if against all the forecasts, the US economic statistics is worse, and eurozone’s inflation shows higher price risks, gold prices may increase. The resistance benchmark for this week may be 1,412.0 USD per troy ounce.

According to the technical analyses, short-term perspectives of gold have deteriorated again after the quotes dived deeper than the resistance of 1,396.12 USD per troy ounce. Medium-term perspectives remain vulnerable, thus, we believe this asset has space for falling.

Last week, the copper cost downed by 0.90% to 3.2645 USD per pound. Nevertheless, early last week the copper prices were demonstrating quite positive dynamics amid the official statistics from China (activity growth in the processing sector) and supply disruption from Indonesia. Copper prices reached a two-week maximum of 3.3955 USD per pound on 5 June.

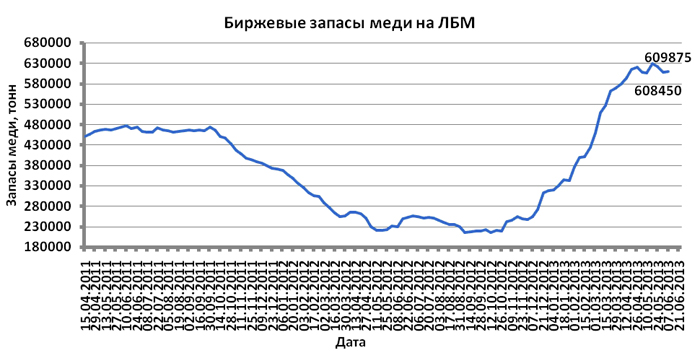

However, strong USD somehow pressured copper prices at the end of the week. Moreover, weak import of China didn’t bring any optimism either : import dropped in May by 0.3% year over year, even though it was expected to grow by 5.0%. Stock reserve of copper increased at Shanghai Futures Exchange by 2155 thousand tons to 181472 thousand thus driving tumbles of the copper cost.

Slightly increased stock reserve of this asset at London Metal Exchange also forced the copper prices to down.

This week, the copper quotes are expected to be under the pressure amid the restricted activity of the investors and weaker statistics than forecasted from China. Indeed, industrial output, retail sales and consumer inflation statistics, published on June 9, showed lower demand from the world largest consumer of this asset.

Overseas statistics can also affect the copper price, particularly, USD industrial statistics for May. This statistics is expected to speak about better situation, thus the copper prices can slightly rise. However, if this statistics is worse than forecasted the copper cost can tumble even more. Copper prices may vary within 3.15 – 3.35 USD per pound this week.

Mikael Verdyan, an analyst at FOREX CLUB, specially for ARKA news agency.

The opinion of the author does not necessarily reflect that of the agency.—0-

Read the news first and discuss them in our Telegram

Tags: