14.05.2012 15:35

YEREVAN, May 14. /ARKA/. The results of elections in France and Greece pushed gold prices to go down last week. The constituents of these countries voted against austerity measures unleashing concerns related to euro zone’s budget consolidation plan implementation and decreasing attractiveness of the European currency.

Gold prices reached a new four-month minimal benchmark of 1,573.71 USD per troy ounce due to U.S. dollar’s appreciation. The tumble in prices is also caused by the speculations on Greece’s possible withdrawal from the euro zone as it failed to assemble a coalition government.

Meanwhile, the situation with government bonds raised a risk of euro zone’s failure to deal with its debts.

On May 10, Thursday, gold quotes reported stability trying to recover the losses. However, the prices dropped at the end of the week after China published weak data on industrial production and retail sales, as well as ongoing political unrest in Greece.

As a result, gold prices dropped by 3.82% to 1,579.30 USD per troy ounce.

Macroeconomic data from the USA and the euro zone will be published this week, which is likely to influence the investors’ sentiments. Of American news we should highlight data on industrial production, consumer inflation and numbers from housing market in April, as well as protocol publication from the last U.S. Federal Reserve’s session, April 24-25. The expected moderately positive statistics from the overseas may support the gold quotes. Gold prices’ resistance level will be 1,615.0 USD per troy ounce this week.

Of European news we should focus on consumer inflation in April and ZEW’s publication on German business sentiments index in May, as well as preliminary GDP figures in the euro zone for the first quarter. The expected weak economic statistics from the region will press gold prices. Supporting benchmark for the gold will be 1,550.0 USD per troy ounce.

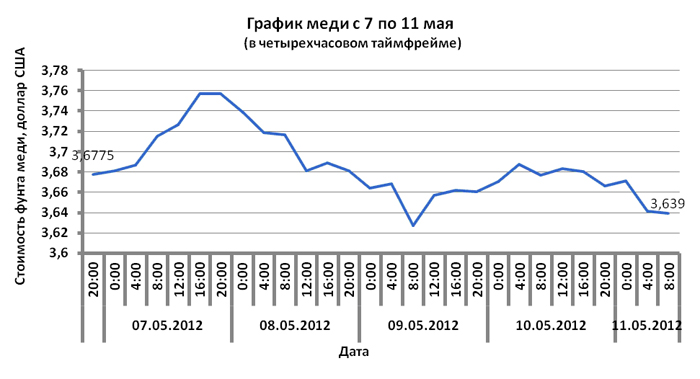

The cost of copper in the futures market last week fell by 2,12% to 3,6390 U.S. dollars per pound on concerns of investors about the worsening economic outlook in Greece and the euro zone as a whole. China’s weak data also pulled tumbles in copper prices.

Indeed, China’s industrial production rose in April by 9.3 % versus projected 12.1 %. Retail sales in China increased by 14.1% in April. ( this indicator was 15.2% in March).

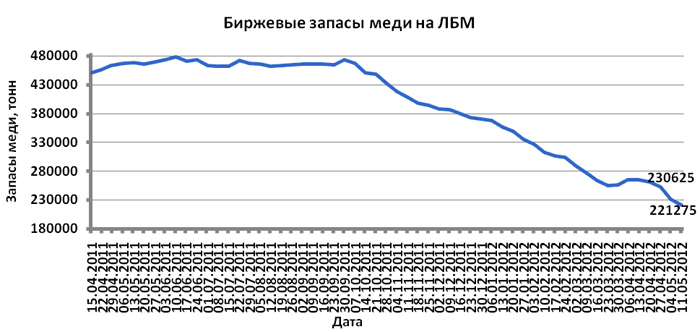

Decreased stock reserve of this asset in London Metal Exchange (LME) supported the quotes last week.

Next week copper dynamics will mainly depend on U.S. and euro zone macroeconomic statistics as well as U.S. dollar’s dynamics. This statistics is expected to be moderately positive. If these forecasts are justified, and data on industrial production and U.S. housing market, as well as German business sentiment index appear as moderately positive, prices of non-ferrous metals, including copper, may recover the losses. However, if this statistics doesn’t justify the hopes, and American dollar consitunes growing, the copper prices may tumble. Anticipated fluctuation range of copper quotes on the futures market is 3.53 – 3.78 USD per copper pound coming week.

Mikael Verdyan, an analyst at FOREX CLUB, specially for ARKA news agency.

The opinion of the author does not necessarily reflect that of the agency.—0--

Read the news first and discuss them in our Telegram

Tags: