06.08.2016 13:45

YEREVAN, August 5, /ARKA/. Strengthening the local capital market and increasing local currency lending were the main themes of a workshop organised by the EBRD and the Central Bank of Armenia (CBA) in Yerevan this week, EBRD Yerevan Office said in a press release.

It said the institutions are working together on a technical cooperation project for the development of a local derivatives market.

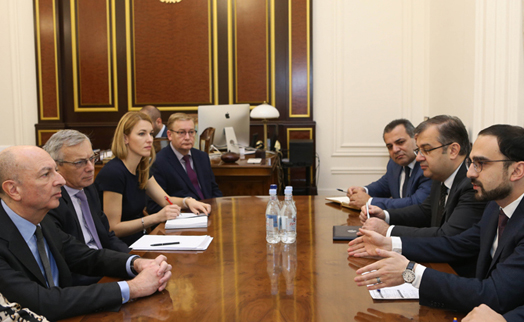

CBA Deputy Governor Nerses Yeritsyan opened the seminar with the title “Money Market and Derivatives – The International and Armenian Perspectives” with the words: “I am glad to have the EBRD here today. We have been working together for a number of years in the development of capital markets. We have always achieved good results that were further validated by the market.”

The workshop provided more than 100 participants, including regulators and market participants, with an opportunity to discuss recent developments.

The EBRD and Armenia are working closely together and in March signed a Memorandum of Understanding about actions in partnership between the Bank and the CBA, including the reform of the derivatives market.

Mark Davis, EBRD Head of Office in Yerevan, said: “Since 2011 we have managed to sign over 30 projects in Armenian dram for an aggregate volume of more than $100 million and we look forward to doing more. This is also possible thanks to the policy dialogue and technical cooperation projects the Bank is engaged in with the authorities, including CBA.”

This year also saw the extension of the EBRD SME Local Currency Programme to Armenia. This framework offers local small and medium-sized enterprises (SMEs) lending in local currency. In exchange for better access to affordable funding, Armenia committed itself to continuing reforms to improve, broaden and deepen its local currency and capital markets.

At the workshop the EBRD also presented two technical cooperation projects under the Local Currency and Local Capital Market Initiative and the MoU.

The first is a report on “Framework for developing money markets in frontier and emerging market economises” that among five countries examines the situation in Armenia discussing the best ways to focus on inflation targeting and other money market related activities.

Such work also has an impact on the EBRD’s business. Inflation forecasting and targeting – supported by proper communications – allows the market to properly price financial instruments, including hedging instruments, and provide more attractive local currency loans.

The second technical cooperation project presented at the workshop was a derivatives reform programme the EBRD is developing together with the CBA.

Jacek Kubas, representing the EBRD Local Currency and Capital Market Development Team and in charge of the programme, said: “This reform is very important for market participants, including the EBRD, as it will open the doors for hedging tools, including foreign currency and interest rate and allow banks and corporates to properly manage their risks, especially if they are heavy exporters like Armenian businesses to Russia.

“We ran similar projects now in four countries, Georgia, Morocco, Ukraine and Armenia, and are glad to see such progress here”.

The draft law, providing for the enforceability of derivatives transactions, including netting, close-out netting and financial collaterals, amends over 17 laws and introduces over 15 new concepts into Armenia’s financial legislation, including settlement finality.

The draft law has been finalised in cooperation with the CBA and is expected to be submitted to parliament in September.

Both projects are well advanced and among a number of action plans specified in the recently signed MoU, including the creation of a High Level Steering Committee. A meeting of this committee took place a day after the workshop.

As a next step it will meet again in September to discuss priority actions for the further development of capital markets.

The EBRD is a leading institutional investor in Armenia, having invested over euro 1 billion in 150 projects in the country’s financial, infrastructure, energy and corporate sectors, with 88 per cent of these projects being in the private sector. -0-

Read the news first and discuss them in our Telegram

Tags: