14.01.2013 15:35

YEREVAN, January 14. /ARKA/. Gold prices slightly tumbled last week as the American regulator published last Thursday its December session protocols. As a result, the quotes of the precious metal reached their week minimum of 1,642.69 USD per troy ounce.

However, following this, the gold prices managed to restore due to the passive performance of the investors prior to another meeting of the European regulator and second phase of talks over the U.S. “budget breakdown.”

The situation had changed by the week’s out after ECB chairman Mario Draghi stated the European regulator would not reduce the interest rates. Hike in gold quotes was mainly triggered by this decision of the ECB, the rise of the principal currency pair and a favorable statistics from China.

Nevertheless, the gold quotes sharply downed on the last day of the previous week as Philadelphia Federal Reserve Bank President Charles Plosser cast doubts over the efficiency of the quantitative easing for cutting an unemployment rate. Moreover, he also supported earlier timeline to tighten the monetary policy than majority of FOMC members. As a result, the gold cost rose by 0.38% to 1,663.02 USD per troy ounce.

Early this week the gold quotes are likely to drop or consolidate amid the expected growth of the American currency. However, the total fall will not happen due to the physical demand in Asia.

The gold dynamics will mainly depend on the forecasted macroeconomic statistics from the U.S. and the eurozone. Of the American news we should focus on the consumer price index, changes in industrial output volume and figures from the housing market in December. Of the European news we should highlight Germany’s changed GDP in 2012 as well as the consumer price index in December.

If the statistics meet the forecasts, and the U.S. and eurozone annual inflation rates are lower from the expected 1.8% and 2.2%, the gold cost may continue slipping.

The technical perspectives for gold have again deteriorated as they failed hitting 1,668.29-USD resistance benchmark. The expected fluctuation range this week will be 1,635.0 – 1,686.0 USD per troy ounce.

Copper prices dove by 1.17% to 3.6585 USDF per pound last week due to weak slowdown tendency early last week amid the curbed activity of the investors prior to the ECB meeting.

Moreover, copper quotes fell amid Charles Plosser’s statements.

Nevertheless, on Thursday, January 10, the copper prices reached a week-maximum amid the statistics on China’s foreign trade implying the high import rates. Moreover, the sharp down of the American currency and Mario Draghi speech have also cast optimism.

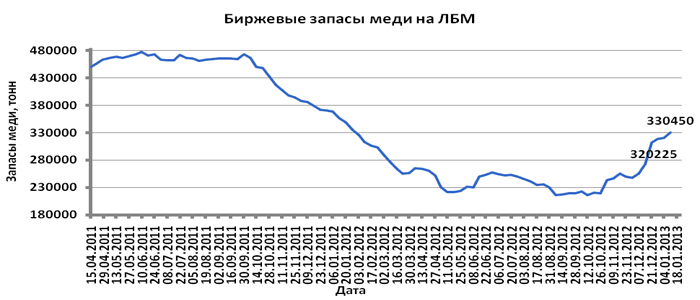

The increased reserve of this asset at London Metal Exchange also prevented hike in copper quotes.

This week the copper dynamics will depend on the USA and China. The industrial and real estate market statistics of the U.S. in December will also be under the spotlight. We expect the economic statistics from China and the U.S. to demonstrate positive dynamics, therefore, the copper prices may rise to 3.72 USD per pound.

However, if the macroeconomic statistics from these two states is concerning, the copper cost may tumble to 3.60 USD per troy ounce. The technical perspectives of this asset we assess as moderate unless the prices are higher from supportive 3.6417 USD per pound.—0-

Mikael Verdyan, an analyst at FOREX CLUB, specially for ARKA news agency.

The opinion of the author does not necessarily reflect that of the agency.—0-

Read the news first and discuss them in our Telegram

Tags: