13.05.2013 17:16

YEREVAN, May 13./ARKA/. We didn’t note again any stability in the dynamics of the gold prices over the past five trading days. Most of the time, the investors were restricting themselves as the better than forecasted U.S. labor statistics, published on May 3, instigated stronger concerns over the terms and intensity of the stimuli measures by the U.S. Federal Reserve. The big question remains whether the American regulator will change the current program on asset purchasing.

In addition, some positive dynamics at the global stock markets, particularly, the record high American stock indices, has also reduced the attractiveness of this metal as a safe-haven asset. The strong USD and no macroeconomic data which could impact the metal market, brought no optimism either. As a result, the gold cost fell by 1.60 to 1,446.95 USD per troy ounce last week.

This week, the gold quotes are likely to down as the world’s largest economy releases better macroeconomic statistics and as the investors are more prone to taking risks. Moreover, the curbed activity of the stock markets focusing on metals will not let the investors relax. Even though, we don’t say the consolidation is impossible, as the stable physical demand will prevent huge drop in the gold quotes. The supporting benchmark this week will be 1,395.0 USD per troy ounce.

The gold dynamics this week will also depend on the U.S. and eurozone’s macroeconomic statistics. Of the American news we should focus on the retail trade, the consumer price index, the volume of industrial output for April, preliminary confidence index by University of Michigan for May and the number of primary unemployment allowance applications for the last week. The expected mixed economic statistics from overseas can weaken the USD positions thus touching off the gold quotes’ upturn. The resisting benchmark this week may be 1,488.0 USD per troy ounce.

Of the European news we should highlight the consumer inflation for April, business sentiment index in Germany published by ZEW for May, and the preliminary GDP of the eurozone for the first quarter. We expect the weak economic statistics of the region will pressure the gold quotes.

The copper prices rose by 2.69% to 3.3820 USD per pound last week due to hopes over economic perspectives of the world’s largest economy. At the same time, positive statistics from China also appeared as optimistic thus supporting the copper quotes. Indeed, China’s trade surplus in April rose to 18.16 billion versus anticipated 16.15 billion dollars. The import increased by 16.8% in April from March’s 14.1%.

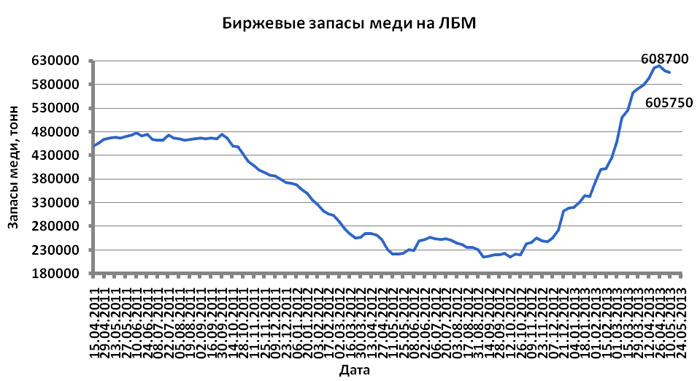

Moreover, the decreased reserve of this asset at the London Metal Exchange and the Shanghai Futures Exchange has also stimulated hike of the copper prices. Reserves of copper at the Shanghai Futures Exchange downed by 18739 thousand tons to 195043 thousand tons last week.

Copper dynamics this week will mainly depend on macroeconomic statistics of the USA, eurozone and China as well as the USD positions.

This statistics is expected to be moderately positive. If these forecasts come true and the U.S. labor statistics, data on industrial output of China, business sentiment index in Germany are moderately positive, the non-ferrous metals, including the copper, will get an impetus for rising. However, if this statistics is different, and the American currency continues growing, the copper prices will down. The anticipated range of fluctuation of the copper will be 3.28 – 3.48 USD per pound. E.O.—0-

Mikael Verdyan, an analyst at FOREX CLUB, specially for ARKA news agency.

The opinion of the author does not necessarily reflect that of the agency.—0-

Read the news first and discuss them in our Telegram

Tags: