22.04.2013 18:09

YEREVAN, April 22. /ARKA/. Last week gold prices tumbled to record low 1,320.84 USD per troy ounce over the two years. Most severely they fell on Monday, April 15, recording lowest downturn over the recent thirty years. Such tendency was due to large-scale liquidations of positions as the amendment to the Dodd-Frank Act was put into force.

From now on, in accordance with the new amendment, the American banks are disallowed to make raw asset transactions on their own. The situation was even deteriorated by the weaker than expected GDP and industrial production statistics from China.

However, at the end of the week gold quotes managed to recover amid the physical purchases at lower prices and weaker macroeconomic statistics from the USA. As a result, gold prices dived by 5.77% to 1,403.53 USD per troy ounce.

This week the gold quotes are very likely to be pressured since the stricter control over the American banks through the Dodd-Frank reforms deprived this asset of most of investment support.

The ongoing outflow of the funds from the metal market units deteriorates the situation as well. The supporting benchmark for gold for the next five days may be 1,345.0 USD per troy ounce. However, the increased physical demand after the recent crash will also prevent gold prices from tumbling.

This week the gold prices will mainly depend on the macroeconomic statistics from the USA and eurozone. Of the American news we should focus on the preliminary GDP for the first quarter, housing market statistics and the number of orders for durable goods for March. Of the European news we should highlight PMI for industrial sector of Germany, France and eurozone, and business conditions index of Germany for April published by IFO. The statistics from overseas is likely to be optimistic, and the European one –negative, that is why USD may increase and gold quotes- drop.

However, if the U.S. GDP is weaker against the forecasts, the gold quotes may slightly rise. The resistance benchmark for the asset will be 1,450.0 USD per troy ounce this week.

Copper prices downed by 5.79% to 3.1465 USD per pound amid the pessimism at the market of commodity and raw material assets. In addition, weak macroeconomic statistics from China deteriorated the situation. Thus, copper prices reached record eighteen-month low 3.0625 USD per pound.

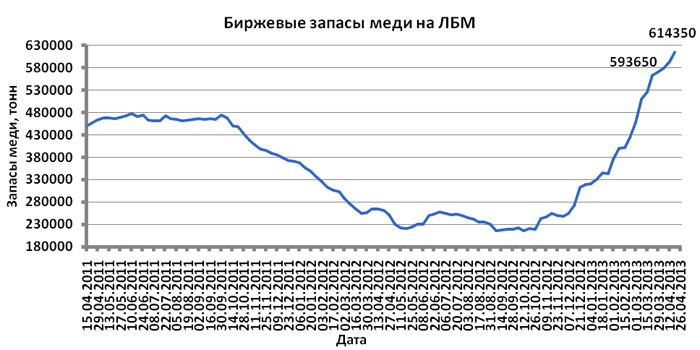

The new record high reserve of this asset at London Metal Exchange also ensured fall in copper quotes

This week, copper cost will mainly depend on economic statistics from the USA, eurozone and China. If the U.S. GDP is favorable, the cost of non-ferrous metals, including copper, will slightly increase. However, this can be hindered by weak index of business activity in industrial sector of the eurozone and China. The copper price may vary within 2.95 – 3.30 USD per pound this week.

Mikael Verdyan, an analyst at FOREX CLUB, specially for ARKA news agency.

The opinion of the author does not necessarily reflect that of the agency. —0-

Read the news first and discuss them in our Telegram

Tags: