20.04.2016 18:53

YEREVAN, April 20. /ARKA/. More than 80% of Unibank’s USD-denominated nominal coupon bonds with the annual yield of 8% have been placed already. The announcement was made at Cbonds Emerging Markets Bond Conference, held on April 14-15 in London, attended by a delegation of Unibank’s top managers.

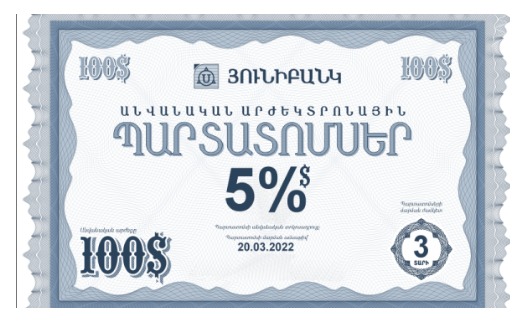

Earlier the bank said it was going to issue a total of 50,000 bonds worth USD5 million with a face value of USD100. The maturity term is 24 months with coupon profit payments to be made quarterly. The redemption of the bonds will be made on April 8, 2018. The minimum package includes 10 bonds worth $1,000. After the placement the bonds are expected to be listed at NASDAQ OMX Armenia stock exchange.

Under the Armenian law on insurance of private bank deposits, funds raised as bonds, as well as bank deposits are guaranteed by the Deposit Insurance Fund in the amounts stipulated by the law.

When addressing the Cbonds Emerging Markets Bond Conference, Ararat Ghukasyan, Unibank Board Member, said the placement of 80% of the bonds is an indication of high confidence of investors and the public’s interest in Unibank.

Ararat Ghukasyan said also participation in conferences of such level is a good opportunity for exchange of experience between experts for a better understanding and assessment of market needs as well as for offering more effective and sought after products.

"We are interested in building effective cooperation at the international level. Today foreign investors show interest in the Armenian market of bonds given their high yield and the legislative regulation of the market. This is undoubtedly a positive trend in the development of possible cooperation and interaction in this direction,' he said.

Over 200 representatives of leading investment banks and funds, management and consulting companies, specializing in the CIS countries, Central and Eastern Europe, attended the London gathering. The conference program consisted of presentations and sessions, which discussed the current situation and prospects of the development of the bond markets, new investment opportunities and practices of the CIS countries and Europe. Discussed were also macroeconomic and legislative issues. A significant place in the program was devoted to topical and dynamic discussions.

Unibank delegation made a presentation on Armenia’s improving investment climate and terms of the first issue of its bonds.

Unibank’s bonds can be acquired at any of its 45 branches or the head office. The placement is scheduled for April 8 to June 14, 2016.

The prospectus contains detailed information about the financial standing of the bank and key information about the bond issue. It is placed on the official website of Unibank at www.unibank.am).

Unibank was founded in October 2001. In 2002 it introduced Unistream system. Its only shareholder is Glover Holding LTD. In 2015 the Bank was reorganized into an open joint stock company. Today Unibank runs 45 branches providing services to over 300,000 customers.

The bank’s assets in 2015 stood at 158.5 billion drams; the liabilities – at 135.6 billion drams; the capital was worth 22.8 billion drams. Its credit investments stood at 110. 1 billion drams. In 2015 Unibank earned 493.2 million drams in net profit. ($ 1 - 480.58 drams). -0-

Read the news first and discuss them in our Telegram

Tags: