12.11.2012 14:56

YEREVAN, November 12. /ARKA/. Last week gold saw rise in prices amid physical demand rally and political events in the USA and China that drove the investors to report profit after the drop of gold prices throughout the past four days. Furthermore, Obama’s re-election for the second term also prompted gold cost hike reaffirming the investors’ hopes for the further ultra-soft monetary-credit policy conducted by the U.S. Federal Reserve.

The threatening tax and budget crisis in the U.S. also encouraged the gold dealers to buy the metal as a safe-haven asset. Gold prices lost correlation to the risky assets last week. Indeed, the correlation coefficient of gold to the main currency pair was -0,511 from 5 to 9 November, whereas a week earlier it was 0,816. As a result, gold cost last week rose 2.92% to 1,731.29 USD per troy ounce.

Early this week, gold quotes are likely to consolidate due to the restricted activity shown by the investors prior to the meeting of the eurozone financial ministers in Brussels on Monday. The main agenda topic may be another financial aid tranche to Greece. If the possible deferment of the aid tranche is confirmed, gold quotes may slightly fall as within a corrective trend. The supporting benchmark for the gold will be 1,700.0 USD per troy ounce this week.

Gold dynamics will also depend on the planned macroeconomic statistics from the U.S. and eurozone. Of the American news we should focus on retail commerce, industrial production, consumer inflation and housing market in October, as well as details on the purchase of the American long-term securities by the foreign investors in September. The anticipated weak economic statistics from overseas can dampen the USD growth resulting in gold cost jump. The resistance level may be 1,763.0 USD per troy ounce.

Of the European news we should highlight the eurozone’s consumer inflation in October, business sentiment index in Germany published by ZEW institute in November, and the preliminary data on eurozone GDP in the third quarter. The weak economic data will pressure the gold quotes.

Copper price slumped 1.38% to 3.4425 USD per copper pound. The significant slip in prices was reported on Wednesday and Friday as after Obama’s re-election the market dealers focused on the “budget breakdown” in the U.S.

Copper cost dropped also due to low rates of global economy growth and concerns about a spread of the European debt crisis to other regions.

Nevertheless, copper prices got support after China had released higher than expected economic statistics.

Indeed, China’s industrial production advanced 9.6% versus the anticipated 9.4% in October. Inflation rates slowdown inspired the investors for the further ease of monetary and credit policy by the Chinese regulator.

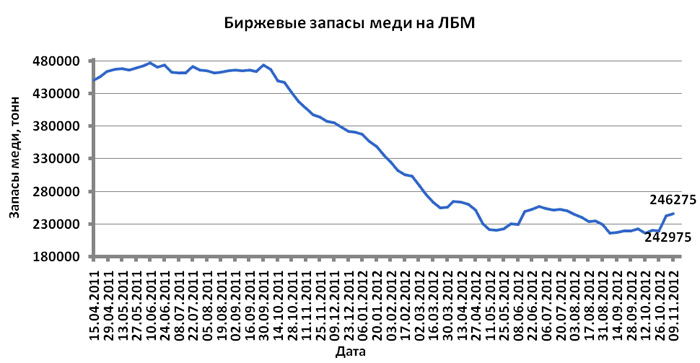

However, the increased reserve of this asset at London Metal Exchange also pressured copper quotes.

This week copper dynamics will mainly depend on the macroeconomic statistics of the United States, eurozone and China, as well as the USD. The statistics is expected to be moderately positive. If the forecasts come true, and the data on the U.S. industrial production, housing market and business sentiment index in Germany are moderately positive, non-ferrous metals, including copper, will rally.

In an opposite case, copper value will tumble. Published on Saturday, November 10, weak data on China’s import will also foster copper cost slip. The expected fluctuation range for copper this week is 3.37 – 3.51 USD per pound.

Mikael Verdyan, an analyst at FOREX CLUB, specially for ARKA news agency.

The opinion of the author does not necessarily reflect that of the agency. —0-

Read the news first and discuss them in our Telegram

Tags: