19.11.2012 19:18

YEREVAN, November 19. /ARKA/. Last week gold prices were mainly tumbling amid the uncertain political situation in the U.S. and concerns about the European economy that drove the investors to report profit after the drop of gold prices. At the same time, uncertain situation around the next financial aid tranche to Greece was curbing the activity of the investors.

Publication on global demand and supply by the World Gold Council in the third quarter also pressured the gold quotes. Thus, the global gold demand slashed by 11.35% to 1,084.6 tons in the 3Q from the same period a year earlier due to purchases by the official sector. Thus, the gold demand tumbled more than was expected. As a result, gold cost dropped 1.33% to 1,711.59 USD per troy ounce last week.

We think the gold quotes will continue consolidating this week, as the investors are still careful and are not willing to make big deals amid the lack of the definite commercial reference points.

Market dealers will wait for the outcomes from the meeting of the eurozone finance ministers, to be announced on Tuesday, November 20.

If the ministers agree on the next aid tranche to Greece, the gold quotes may slightly rise.

Meanwhile, the uncertain situation around tax and budget crisis in the U.S. will curb the activity of the investors. The resistance benchmark for the gold may be 1,739.0 USD per troy ounce this week.

Gold dynamics may also depend on the macroeconomic statistics from the U.S. and the eurozone. Of the American news we should focus on the publication of the initial unemployment allowance applications for the last week and housing market in October. Of the European news we should highlight the publication of the final data on Germany’s 3Q GDP, and preliminary numbers on business activity in manufacturing sector of the eurozone in November. The expected moderately positive data from the overseas, and weak macroeconomic statistics from the eurozone may pressure the gold quotes.

Strong USD positions will also force gold cost to fall, as the gold prices in USD will be becoming less attractive for the other currency holders. The supporting benchmark for the gold this week will be 1,690.0 USD per troy ounce.

Copper price slumped 0.15% to 3.4475 USD per pound amid the restricted activity of the investors. Most sharply copper quotes tumbled on Wednesday and Friday, as the attention of the investors was focused on the “budget breakdown” in the U.S.

Copper prices also dropped due to the low stock indices and strong USD, low rates of global economy growth and concerns around Greece.

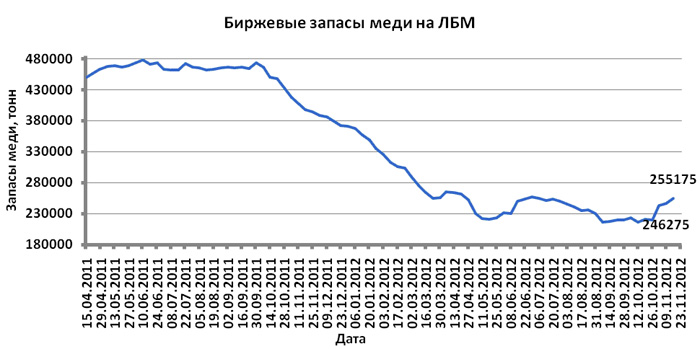

The increased reserve of this asset at London Metal Exchange also pressured copper quotes.

This week copper dynamics will mainly depend on the macroeconomic statistics of the United States, eurozone and USD positions. If the data meet the expectations and are moderately positive, copper prices may rise. China’s manufacture data published by HSBC in November will be also important for copper prices.

However, if this statistics is disappointing, and the American currency continues growing, copper cost will slip. The expected fluctuation range for copper will be 3.37 – 3.52 USD per copper pound this week.

Mikael Verdyan, an analyst at FOREX CLUB, specially for ARKA news agency.

The opinion of the author does not necessarily reflect that of the agency. —0-

Read the news first and discuss them in our Telegram

Tags: